Last updated on April 13, 2023

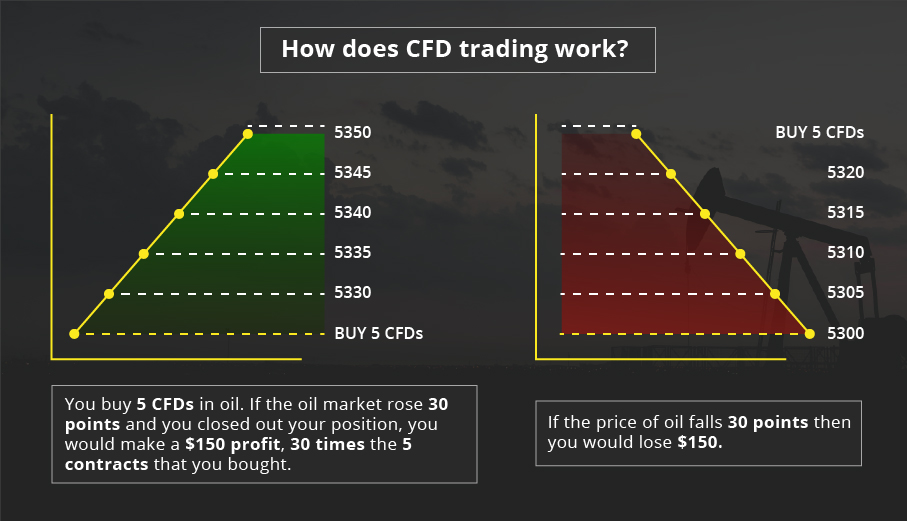

The main purpose of this post is to know How does CFD trading work. If a stock has an ask price of $25.26 and the trader buys 100 shares. The cost of the transaction is $2,526 plus commission and charges. This trade needs at least $1,263 in free cash at a traditional broker in a 50% margin account. While a CFD broker formerly required just a 5% margin, or $126.30. A CFD trade will show a loss equal to the extent of the spread at the time of the transaction. So, if the spread is 5 cents; the stock needs to gain 5 cents for the position to hit the break even price. You will see a 5 cent increase. If you own the stock out right. But would have paid a commission and incurred a larger capital outlay.

If the share rallies to a bid price of $25.76 in a traditional broker account. It can be sold for a $50 gain or $50/$1263=3.95% profit. Nevertheless, when the national exchange reaches this price; the CFD bid price may only be $25.74. The CFD profit will be lower because the trader must exit at the bid price. And the spread is higher than on the regular market. In this example, the CFD trader earns an estimate $48 or $48/$126.30=38% return on investment. The CFD broker might also require the trader to buy at a higher initial price; $25.28 for example. Even so, the $46 to $48 earned on the CFD trade denotes a net profit. While the $50 profit from owning the stock outright doesn’t contain commissions or other fees; putting more money in the CFD trader’s pocket.

The Advantages: Larger Leverage

CFDs offer higher leverage than traditional trading. Average leverage in the CFD market is subject to regulation. It once was as low as a 2% margin (50:1 leverage). But is now limit in a range of 3% (30:1 leverage) possibly will go up to 50% (2:1 leverage). Lower margin requirements mean less capital outlay for the trader/investor, and bigger potential returns. But increased leverage can also magnify losses.

Many CFD brokers provide products in all the world’s major markets, allowing around the clock access.

Certain markets have rules that prohibit shorting; require the trader to borrow the tool before selling short. Or have different margin requirements for short and long positions. CFD instruments can be short at any time without borrowing costs for the reason. That the trader does not own the underlying asset.

CFD brokers offer several of the same order types as traditional brokers including stops; limits as well as contingent orders like “One Cancels the Other” and “If Done.” Some brokers offer guarantee stops; that charge a fee for the service or recoup costs in different way. Brokers earn money when the trader pays the spread and most do not charge commissions or fees of any kind. To buy, an investor must pay the ask price, and to sell/short, the trader must pay the bid price. This spread may be small or large depending on volatility of the underlying asset and fix spreads are often accessible.

How does CFD trading work

Certain markets require minimum amounts of investment to day trade; or place limits on the amount of day trades that can be made within certain accounts. The CFD market is not bound by these restrictions and all account holders can day trade if they want. Accounts can usually be opened for as little as $1,000, although $2,000 and $5,000 are common minimum deposit requirements.

Brokers currently offer stock, index, treasury, currency, sector and commodity CFDs; so speculators in various financial vehicles can trade CFDs as an alternative to exchanges.

While CFDs provide an attractive alternative to traditional markets, they also present potential pitfalls. For one, having to pay the spread on entries and exits eliminates the possible to profit from small moves. The spread also decreases winning trades by a small amount compare to the underlying security; and will increase losses by a minor amount. So, while traditional markets expose the trader to dues, regulations; commissions and higher capital requirements, CFDs trims traders’ profits through spread costs.

Also please note that the CFD industry is not highly regulate; and the broker’s credibility is base on reputation; longevity, and financial position rather than government standing or liquidity. There are outstanding CFD brokers, but it’s important to investigate a broker’s background before opening an account.

How does CFD trading work

How does CFD trading work is fast moving and necessitates close monitoring. There are liquidity risks and margins you require to maintain; if you can not cover reductions in values; your provider may close your position; and you will have to meet the loss no matter what subsequently happens to the underlying asset. Leverage risks expose you to bigger potential profits but also greater potential losses. Even though stop loss limits are available from many CFD providers; they can not guarantee you won’t suffer losses; especially if there’s a market closure or a sharp price movement. Execution risks also may happen due to lags in trades. For these reasons, they are ban and unavailable to residents in the U.S.

How to Trade in Financial Markets in Dubai, Online business in Dubai

To now How does CFD trading work and advantages to CFD trading include lower margin requirements. easy access to global markets, no shorting or day trading rules and little or no dues. However, high leverage magnifies losses when they happen; and having to pay a spread to enter and exit positions can be costly; when large price movements do not occur.